Amãna Bank continued its impressive performance amidst economic challenges to record a strong first half of 2021, in which the Bank’s Profit Before Tax (PBT) doubled or grew by 102% YoY to reach LKR 505.7 million from LKR 250.5 million recorded in H1 of 2020. Profit After Tax (PAT) for the same period significantly grew by 70% to reach LKR 289.3 million in comparison to LKR 170.4 million achieved a year ago.

In Q2 alone PBT and PAT grew YoY by 310% to LKR 288.6 million and 291% to LKR 158.6 million respectively from the corresponding quarter of 2020, which was heavily marred by the outbreak of Covid-19 in the country.

The first half of 2021 also saw an 11% increase in Customer Advances to close at LKR 69.4 billion, thereby showing signs of gradual improvement in economic activity despite many obstacles faced due to the pandemic, while Customer Deposits grew by 9% to close at LKR 90.9 billion. The growth in customer deposits was achieved whilst maintaining a healthy CASA ratio of 46%. Despite challenging market sentiments, the Bank’s NPA continued to remain below the industry average where Gross NPA and Net NPA stood at 3.9% and 1.2% respectively, owing to prudent portfolio management and prompt customer engagement. The Bank’s Total Assets during the 6 months grew by 9% to close at LKR 108.7 billion as at 30 June 2021.

As a result of its growth in advances aided by a healthy financing margin of 3.9%, the Bank’s Net Financing Income grew significantly by 34% YoY to close mid-year at LKR 2.0 billion, of which Rs 1.1 billion was contributed from Q2 alone. Net Operating Income after accounting for impairment closed at LKR 1.97 billion (up YoY by 14%) and LKR 1.03 billion (up YoY by 32%) for H1 and Q2 respectively. Following the Bank’s ongoing effort to keep a close tab on its costs, which resulted in a 4% reduction in Operating Expenses in comparison to H1 2020, the Bank recorded an impressive 74% YoY growth in Operating Profit before VAT on Financial Services to reach LKR 709.3 million, of which LKR 400.5 million came in Q2. The Bank’s aggregate tax contribution for the first half, amounting to LKR 420.0 million accounted for 59% of the Bank’s Operating Profit before all taxes.

Commenting on the Bank’s performance, Chief Executive Officer Mohamed Azmeer said “Having resiliently withstood the challenges posed by the Covid-19 pandemic, I am happy to note that Amãna Bank has come back strong to record remarkable numbers in terms of both profitability and asset growth during the 1st Half of 2021. In achieving such performance I am thankful to the guidance given by our Board of Directors, our passionate employees as well as to all our customers, for continuing to place their trust and confidence in our people friendly banking model, which recently reached the historic milestone of 10 years in operation. I believe that in line with our 5 year Strategic Plan, which is enabled by our well-engaged and optimized team whilst upholding the principles of our universal value proposition, this growth momentum will be sustained throughout the year despite various challenges faced by the country’s economy.”

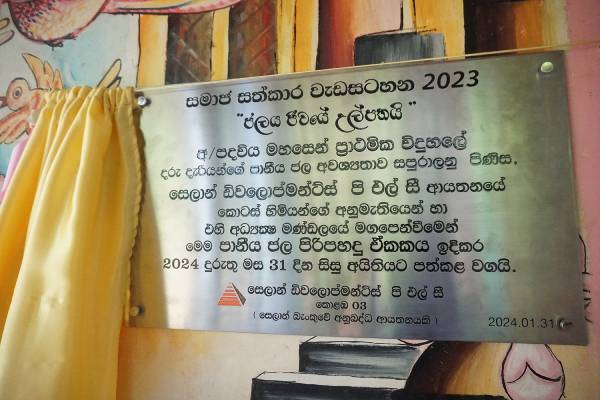

On 1 August 2021, Amãna Bank completed 10 successful years of People Friendly Banking, during a period in which the Bank crossed the milestone of LKR 100 billion in Total Assets, while enabling growth and enriching lives of over 380,000 customers. Testifying the progress it has made in a short period of time, the Bank was recognized as the ‘Best Up and Coming Islamic Bank of the World’ by Global Finance Magazine USA as well as being recognized as the ‘Fastest Growing Retail Bank in Sri Lanka’ by Global Banking and Finance Awards UK.

Amana Bank PLC is a stand-alone institution licensed by the Central Bank of Sri Lanka and listed on the Colombo Stock Exchange with Jeddah based IsDB Group being the principal shareholder having a 29.97% shareholding of the Bank. The IsDB Group is a ‘AAA’ rated multilateral development financial institution with a membership of 57 countries. In October 2020 Fitch Ratings Sri Lanka affirmed the National Long Term Rating of Amãna Bank to BB+(lka) with a Stable Outlook. Amãna Bank does not have any subsidiaries, associates or affiliated institutions, other than its flagship CSR project the ‘OrphanCare’ Trust.