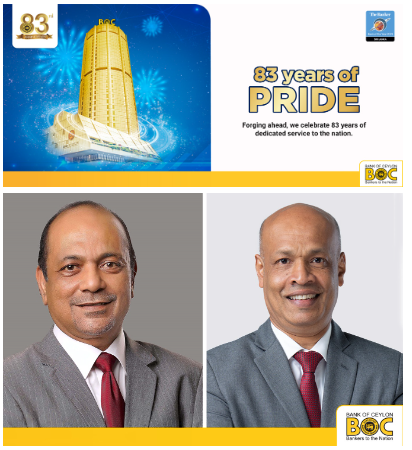

Sri Lanka’s No. 1 Bank, Bank of Ceylon, marked its 83rd Anniversary on Monday, 1st August 2022. The Bank celebrated the occasion beginning with a multi-religious ceremony at the Bank’s Head Office with the participation of distinguished guests comprised of customers and well- wishers.

The event was held with the patronage of the Bank’s Chairman, Mr. Kanchana Ratwatte, Members of the Bank’s Board of Directors, the General Manager, Mr. K. E. D. Sumanasiri, and the Corporate and Executive Management and Bank officials. In line with the ceremony, the branch network also celebrated this important milestone at their own premises with the participation of customers and well-wishers.

To mark this special day, BOC symbolically launched the “My Health” account emphasising its innovative spirit in delivering novel value additions to customers. In addition, the Bank also launched BOC Foreign Circle, a specialised unit geared to delivering superior quality to overseas based customers.

Of further note is the opening of the newly refurbished Bank’s historically significant 1st branch at 41, Bristol Street, Colombo 1, known as the “City Office” on the same day.

The Bank’s Chairman Mr. Kanchana Ratwatte said, “I believe it is a commendable achievement for a corporate brand to reach its 83rd anniversary in its journey. As a trailblazer in the industry and a dedicated corporate citizen, Bank of Ceylon (BOC) commemorates this day with humility. With a rich heritage that has evolved along with Sri Lankan culture, and as the No. 1 Bank in the country, BOC’s purpose has always been to enrich the lives and the livelihood of the citizens of Sri Lanka. Hence, innovation and developments towards digitalisation is an organic process within the bank. I wish to take this opportunity to thank our valued customers and all other stakeholders on behalf of the Bank for the confidence placed on the bank and inspiration given to continue the Bank’s legacy”.

“Our Journey as the No. 1 Bank in the country has always been a challenging, yet inspiring one,” stated the General Manager of Bank of Ceylon, Mr. K. E. D. Sumanasiri.

“We must thank all our staff members especially, including those who were there since the inception, our loyal customers and valued stakeholders for setting the foundation that the Bank could build itself strongly and steadily to survive and thrive even during strenuous times. Bank of Ceylon ensures that it upholds the values that it was built on and ensures that it has a strong footing both locally and internationally. As the largest bank that boasts of an asset base that exceeds four trillion rupees, BOC ensures that it redistributes its wealth to enhance the country’s wellbeing, through a strong inter-connected branch and digital network and a product portfolio that is developed to cater to the needs of our customers around the clock, wherever they are. We have introduced new initiatives such as “SME Circle” and “Export Circle” by taking a step to further develop entrepreneurship within the local SME and export sectors. This was an extension of BOC’s decision to assist customers through specialised concessionary schemes to overcome continuous economic challenges that took place in recent times. As a prominent financial institution, we are also committed to build a financially and digitally inclusive community aiming for a positive impression on economy.” Mr. Sumanasiri further added.

From the inception of the Bank, with the opening of its first branch, the “City Office Branch”, Bank of Ceylon has increased its footprint to include a network of up to 649 branches, and 1,415 ATMs, CDMs and CRMs across the country. Its overseas presence includes branches in Chennai, Male, Hulhu-Male, Seychelles and a banking subsidiary in London. BOC has systematically established its roots within every facet of banking and finance, simultaneously building a strong affiliation with the international banking network. With these strong ties BOC leads the trade finance and inward remittances market in Sri Lanka.

Adopting the latest digital banking technologies, the Bank successfully embarked into green banking where it accommodated strategies to reduce its carbon footprint and increase its usage of renewable energy. BOC has built its strategic green banking initiatives according to United Nation’s SDG guidelines to ensure that the intended value is generated to all stakeholders.

Being recognised by Brand Finance Lanka as the Country’s No. 1 Banking Brand with a brand value of over Rs. 53 billion, Bank of Ceylon boasts of a strong balance sheet with assets worth over Rs. 4 trillion and deposits of over Rs. 3 trillion.

“The Banker” Magazine U.K. named Bank of Ceylon as the “The Bank of the Year 2021” and also recognised it among the “Top 1000 Banks” in the world with a country ranking of No. 1, again by “The Banker” magazine, UK.

“SLIM-Kantar People’s Awards 2022”, adjudged Bank of Ceylon as the “People's Service Brand of the Year 2022” and “the People’s Banking Services Brand of the Year 2022,” which are two prominent awards in the ceremony based on a people’s vote. In recognition of the contribution towards promoting digital inclusivity in banking, BOC was awarded the prestigious “Overall Gold Award for Excellence in Interbank Digital Payments” at the LankaPay Technnovation Awards 2022 organised by the Lanka Clear Pvt Ltd.

With many prestigious accolades and recognition under its belt, Bank of Ceylon is geared to strive further to empower and enable the nation through excellence in banking.