- Personal Loans

- Housing Loans

- Vehicle Loans / Leasings

- Savings & Current Accounts

- Fixed Deposits

- Bank Special Notices

Loans

Investment

News

No results found

We couldnt find any result based on your search

HDFC Gold Advance

| Indicative Rate (P.A) | Tenure | Max Loan Amount |

| 14.50% | Contact Bank | Contact Bank |

|---|

Features

Low interest rate

High advance amount

Maximum security of a government owned bank

One-year repayment period

Settle the loan at any time without prior notice

Ability to make partial payments any time

HDFC Educational Loan

| Indicative Rate (P.A) | Tenure | Max Loan Amount |

| Up to 15.00% | Up to 10 Years | Contact Bank |

|---|

Features

Loan Installment

The monthly installment can be up to 60% of the salary for eligible borrowers.

For others, it is subject to evaluation based on the disposable income accepable to the bank.

Repayment

Equal monthly installments based on diminishing capital.

HDFC Guarantor Loan

| Indicative Rate (P.A) | Tenure | Max Loan Amount |

| Contact Bank | Up to 5 Years | LKR 1,000,000 |

|---|

Features

With the HDFC Guarantor Loan, employed individuals can access funding, benefit from reasonable repayment periods, and enjoy competitive interest rates.

Up to 55% of your salary can be considered as the monthly loan installment.

Kedella Housing Loan

| Indicative Rate (P.A) | Tenure | Max Loan Amount |

| 15.00% | Up to 15Years | Contact Bank |

|---|

Features

Purchase of a house

Purchase of a plot of land to build a house

Building a house

Adding extensions to an existing house

Completing a partly built house

Obtaining water facilities, sanitary facilities, and electricity

Settling an existing housing loan

SHRAMA UDANA

| Indicative Rate (P.A) | Tenure | Max Loan Amount |

| Up to 17.00% | Contact Bank | Contact Bank |

|---|

Features

Purchase of a house

Purchase of a plot of land to build a house

Building a house

Adding extensions to an existing house

Completing a partly built house

Obtaining water facilities, sanitary facilities, and electricity

Settling an existing housing loan

Sirisara Housing Loan

| Indicative Rate (P.A) | Tenure | Max Loan Amount |

| Up to 15.00% | Contact Bank | Contact Bank |

|---|

Features

Purchase of house hold appliances

Furniture for the home

Any lifestyle enhancement expense acceptable to the bank

Leasing

| Indicative Rate (P.A) | Tenure | Max Loan Amount |

| Up to 25.00% | Contact Bank | Contact Bank |

|---|

Features

Minimal equity contribution by the lessee

Fast credit processing channel and simple documentation

Full use of the asset without ownership

Fixed or flexible rental schemes

Concessionary premature settlement options

Ability to make part capital settlements during the lease period

The lowest rentals available in the market

Leasing services accessible through our entire branch network / No requirement to be an existing account holder of HDFC Bank

No results found

We couldnt find any result based on your search

Features

Minimum Deposit : Rs. 2000/-

Attractive Interest Rate : Enjoy attractive interest rates.

Special Housing Loans : Special terms on housing loans, to achieve your dream of owning a home.

Free Standing Order : Set up a free, standing order to remit funds

Easy Loan Installment Payments : Pay monthly HDFC Housing Loans installments through your Prathilaba Saving Account.

Features

Higher Interest Rates: Enjoy higher interest rates, ensuring that your child's savings grow faster.

Flexibility: Open an account on behalf of a child from infancy to the age of 18.

Minimum Initial Deposit: Start with a minimum initial deposit of Rs 2,000/-.

Attractive Gifts: With the increasing deposit balance, your child becomes eligible to receive attractive gift schemes. Account holders of 14 years and below will be eligible for the gift scheme

Free HDFC Till: Receive a free HDFC till with an account opening, encouraging the enthusiasm for saving.

Smart Goals

| Category | Indicative Rate (P.A) |

| Special Savings | Contact Bank |

|---|

Features

Minimum Savings Period of 3 Years : Save over a period of three years. At the end of this period, withdraw your deposits along with the accumulated interest.

Affordable Account Opening : Open your account with just Rs. 2,000/-

Higher Interest Rates : Competitive interest rates.

Flexibility and Convenience : Deposit any amount of money at any time, allowing you to plan ahead and achieve your targets within the three-year timeframe.

Incentive to Save : Interest is calculated on a daily basis and credited to your Smart Goals account monthly.

SET FOR LIFE

| Category | Indicative Rate (P.A) |

| Teen / Youth Savings | Up to 7.72% |

|---|

Features

High Returns : Delivers returns that are well above the market's interest rates

Adjusted for Inflation : Automatically adjusts to inflation, ensuring that the interest rate increases accordingly.

Greater Flexibility : There are no fixed installment requirements. Start with Rs. 2000 and deposit any amount on a daily, weekly, monthly, annual, or lump sum basis.

Nominee : The nominee is entitled to the accumulated amount, should the unforeseen occur.

Loan Benefits : Obtain a loan of up to 70% of the accumulated amount instantly, providing you with additional financial flexibility.

HDFC Vishrama Rekawarana

| Category | Indicative Rate (P.A) |

| Senior Citizens | Up to 7.72% |

|---|

Features

Opportunity to earn the highest interest return.

Caters to the financial needs of a broad range of clientele.

Minimum initial investment is just Rs. 2000

A high-security investment ranked against mortgaged security, providing investors with peace of mind.

Ability to obtain housing loans after a 10–15-year period of accumulation of funds.

Thilina Rakawarana

| Category | Indicative Rate (P.A) |

| Children Savings | 6.00% |

|---|

Features

Guaranteed Sum : Make a one-time single deposit and your child will receive an Entitlement Certificate ensuring the guaranteed amount when they reach 18 years of age, regardless of interest rate fluctuations.

Maturity Certificate : A Maturity Certificate will be issued at account opening, providing documentation of the guaranteed value your child will receive.

Flexible Deposit Options : Choose the deposit amount based on your preferences and financial capabilities. The guaranteed amount depends on deposit value, period, and age of child.

Features

Minimum Deposit: Rs. 15,000/-

Interest Interest : A higher interest rate than normal savings accounts. This rate is based on the prevailing fixed deposit interest rates in the market.

Interest is calculated daily and deposited monthly.

ATM card: It will be issued free of charge.

E- banking facility: Free of charge.

Fixed Deposit

| 1 Month | 2 Months | 3 Months |

| 8.00% | -- | 7.50% |

|---|---|---|

| 6 Months | 12 Months (1Y) | 24 Months (2Y) |

| 8.00% | 9.00% | 9.00% |

Features

Easy Investment: Open your fixed deposit with minimum Rs. 25,000.

Flexibility in Tenure and Interest Payments: Choose your fixed tenure from 3, 6, 12, 24, 36, 48, and 60 months. Interest can be earned monthly, annually, or at maturity, depending on your investment period.

Rewards for High Investments: Enjoy exclusive interest rates and additional benefits when you make high-value investments.

E-Banking: Experience ease and flexibility with E-Banking and SMS alerts.

Automatic Renewals: Ensure that your investment continues to grow without interruption, guaranteeing better returns.

No results found

We couldnt find any result based on your search

No results found

We couldnt find any result based on your search

No results found

We couldnt find any result based on your search

Special Notices

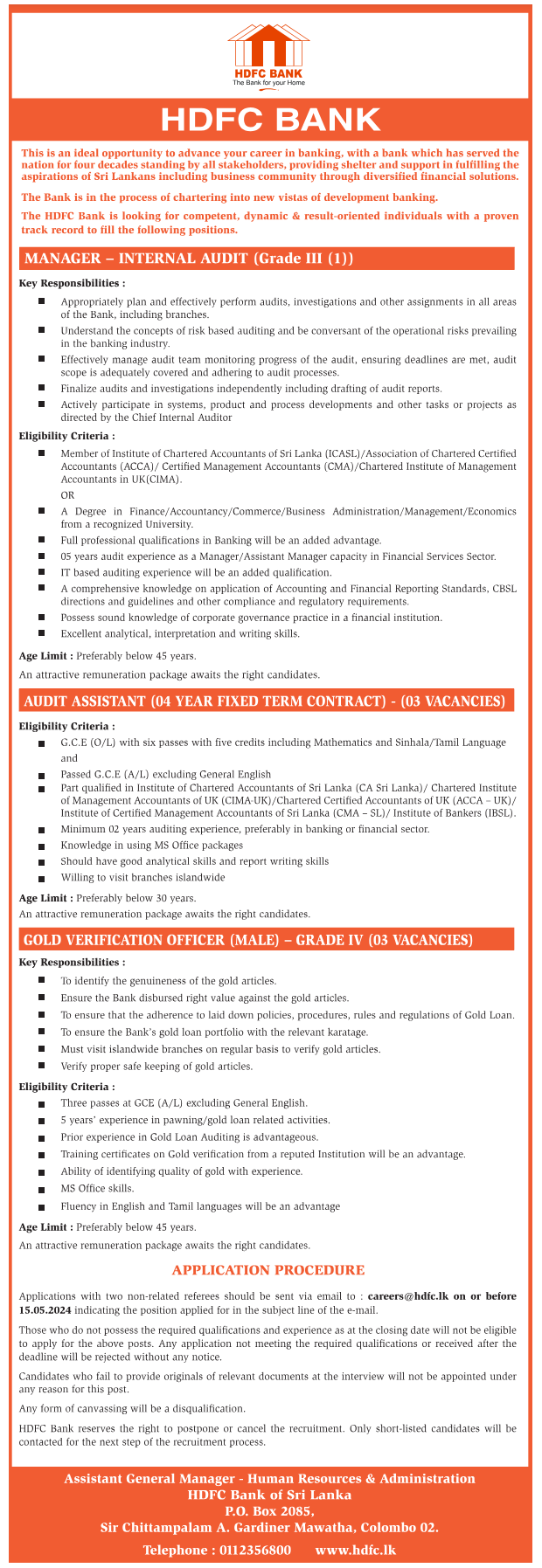

Vacancy Advertisement for Court Clerk Batticoloa & Homagama Branch

Vacancy Advertisement for DBA,IT Support Engineer,Information Security Threat Analyst & Software Engineer